Investment Criteria

All investments are screened

with the objective of having no

exposure to tobacco, gambling,

alcohol, fossil fuels, armaments,

old growth logging, nuclear,

child labour or animal testing.

Instead the portfolio includes

investments in positive activities

such as renewable energy,

healthcare, recycling, social

infrastructure and social

benefit bonds.

Investment Objective and Strategy

The Trustee of the Community Impact Foundation is responsible for all aspects of its investment objective, strategy and investments held.

The Trustee has taken into account the following: the need to donate a minimum of 4% per annum of the corpus of the CIF to eligible charities; the likelihood of inflation affecting the value of the investments and income generated; the risk of capital or income loss; the liquidity of the investments; the costs of investment transactions; and the benefits of diversification of investments.

Furthermore, public ancillary funds are prohibited from: making investments that are not on an ‘arm’s-length’ basis; investing in collectables; trading or operating a business; and, borrowing money (except in limited short term ‘bridging’ circumstances); or providing security over any of its assets.

Taking into account the above, the investment objective set for the CIF is to achieve a return after fees at least equal to CPI inflation + 4% per annum, measured over rolling 10 year periods.

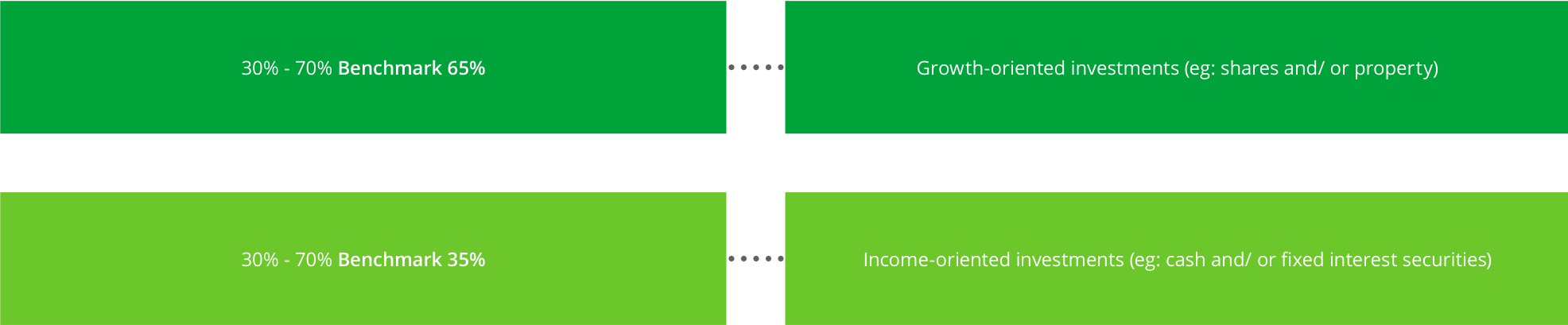

The Trustee believes that the best way to achieve the investment objective is to invest a significant portion of the assets in growth-oriented investments (such as shares and property).

The Trustee also believes it would be prudent to have some exposure to income- oriented investments (such as cash and/or fixed income securities), with an increased emphasis on such investments when sharemarket valuations appear stretched or where there appears to be a better risk/return trade-off in the immediate future from holding such securities.

The Trustee has also committed to including a diversified range of impact investments in the portfolio. Impact investments target competitive financial returns and positive social and environmental impacts.

Based on the investment strategy outlined above, the Trustee has decided that the broad investment ranges for the Community Impact

Foundation are as follows:

The full investment strategy document pertaining to the Community Impact Foundation is available upon request.